If you see the below pop-up when lodging a return in the Electronic Disclosure System (EDS) for a local government election, it means that you are required to give an additional return under the Electoral Act 1992.

Donors who make gifts of $1,000 or more to a registered political party in a local government election, either cumulatively or as a lump sum, you are required to give two returns to the ECQ:

- One under section 125A of the Local Government Electoral Act 2011 (LGEA) – This is the return you were lodging when you saw the ‘Additional disclosure requirement’ pop-up.

- One under section 265 of the Electoral Act 1992 (EA) – This is the additional return that you are required to lodge.

To lodge your additional return in the EDS under section 265 of the Electoral Act 1992, please use the following instructions:

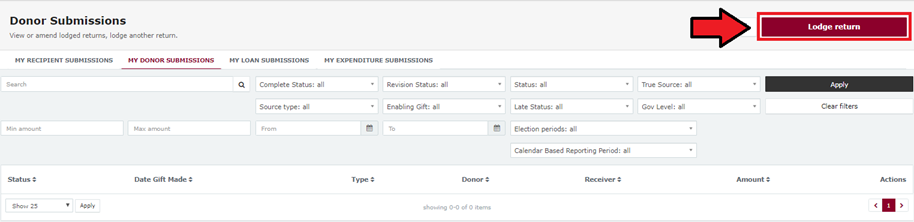

1. From your My Submissions page, click ‘Lodge Return’.

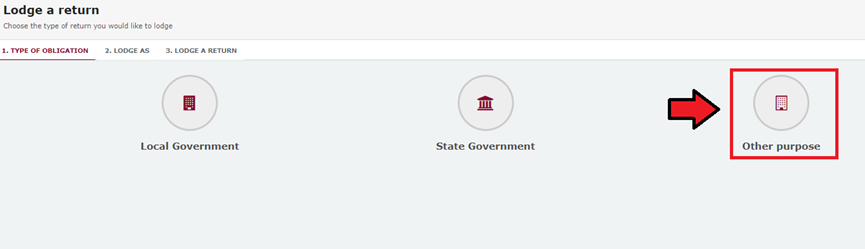

2. Click ‘Other Purpose’.

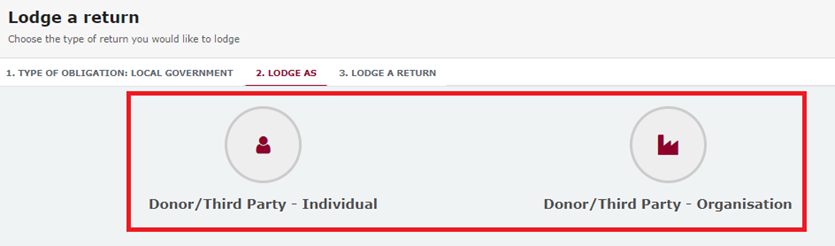

3. If you made the gift as an individual, click ‘Donor / Third Party – Individual’.

If you made the gift as an organisation, click ‘Donor / Third Party – Organisation’.

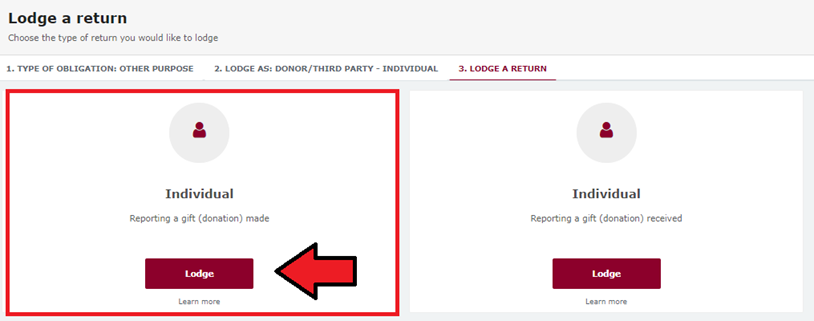

4. Click ’Reporting a gift (donation) made’.

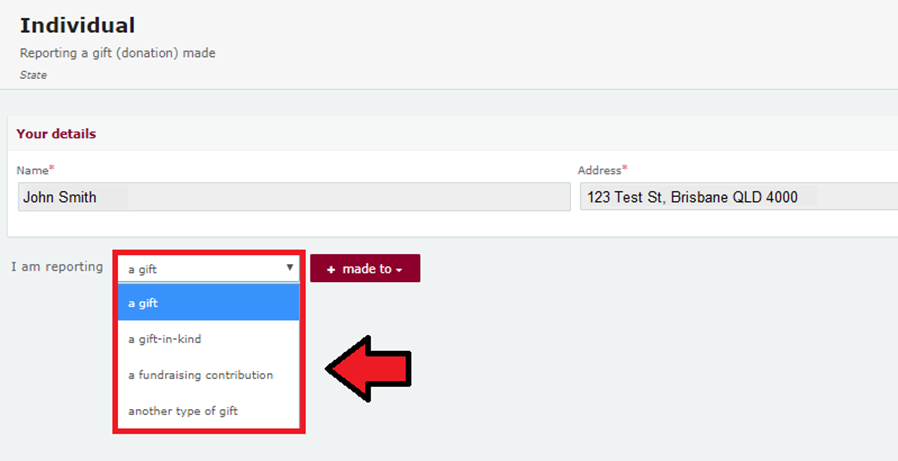

5. Select the gift type from the drop-down menu. This should be the same as the gift type you selected when lodging your return under the Local Government Electoral Act 2011.

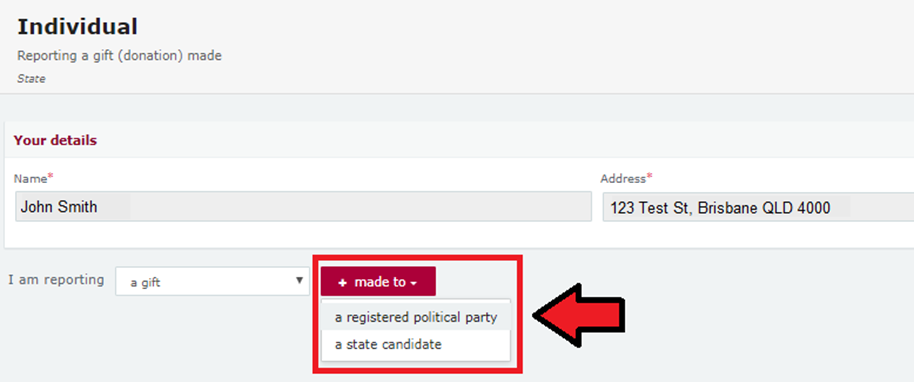

6. Select ‘Registered political party’ as the type of recipient.

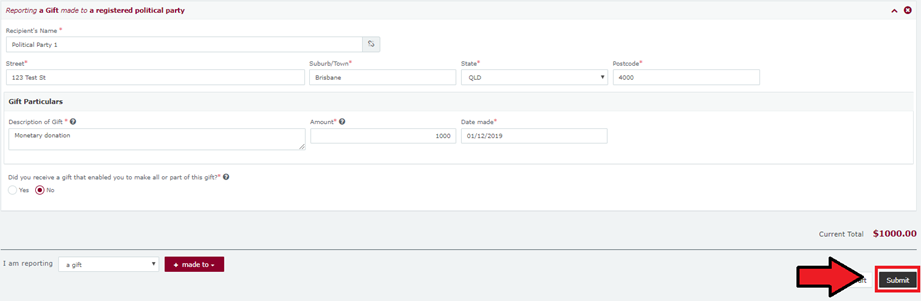

7. Complete all mandatory fields. The information should be the same as the return that you submitted under the LGEA. Then click ‘Submit’.

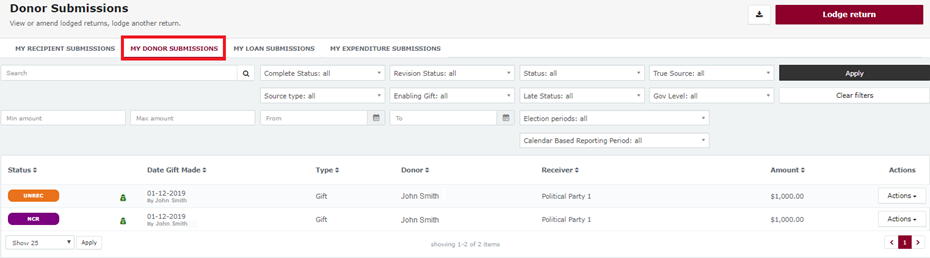

8. The return will appear in your My Donor Submissions page as ‘UNREC’ (Unreconciled), until the party lodges a matching return.

Note: Your return under the LGEA does not need to be reconciled by the party and will appear as ‘NCR’ (No Corresponding Return Required).